Discover the Advantages of Cooperative Credit Union Today

Cooperative credit union stand apart for their special strategy to economic solutions, using a distinct set of advantages that deal with their members' demands in a manner that standard banks usually battle to match. From individualized client service to affordable interest rates and a community-focused approach, cooperative credit union offer a compelling alternative for individuals seeking greater than simply the normal financial experience. By checking out the benefits of cooperative credit union better, one can find a banks that prioritizes its participants' economic wellness and aims to construct lasting relationships based upon depend on and assistance.

Subscription Benefits

Subscription advantages at credit rating unions incorporate a range of financial advantages and services tailored to cultivate member success and well-being - Credit Union Cheyenne. One substantial advantage of credit score union subscription is the customized client solution that members get.

Furthermore, lending institution regularly offer access to lower rates of interest on car loans, greater rates of interest on financial savings accounts, and lowered fees compared to larger economic establishments. Members can benefit from these beneficial prices to conserve money on fundings or expand their financial savings better. Credit history unions commonly use a range of monetary items and solutions, such as credit scores cards, home loans, and retirement accounts, all made to fulfill the varied requirements of their participants.

Reduced Charges and Better Rates

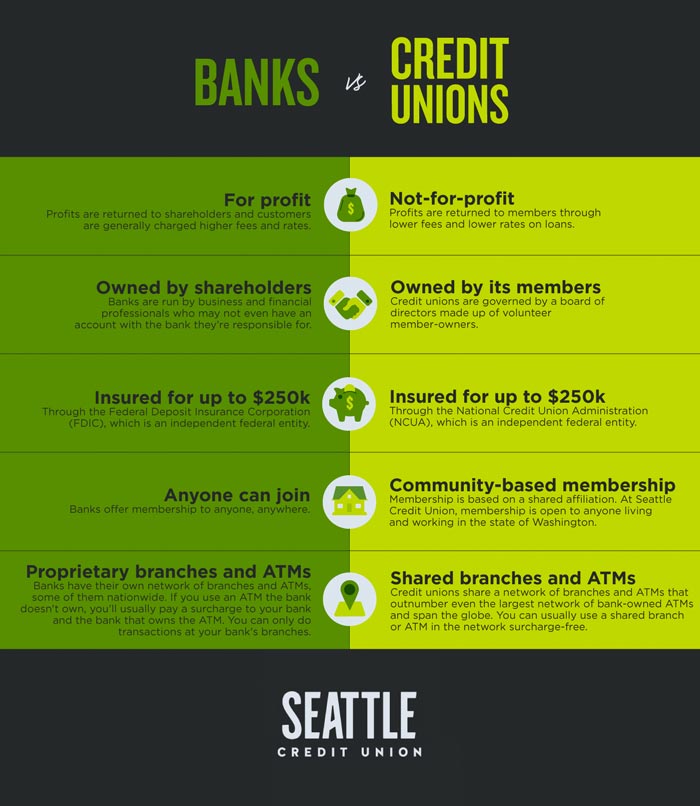

Debt unions stand apart for their commitment to offering lower costs and much better prices, lining up with their objective to provide members financial benefits that traditional financial institutions may not focus on. Unlike banks that aim to make best use of profits for investors, lending institution are not-for-profit organizations owned by their members. This framework allows lending institution to focus on offering their participants' benefits, causing lower fees for solutions such as inspecting accounts, loans, and charge card. In addition, lending institution frequently supply more affordable passion rates on interest-bearing accounts and lendings contrasted to traditional banks. By keeping costs low and prices affordable, cooperative credit union assist members conserve money and attain their economic objectives more effectively. Members can profit from decreased expenses on vital monetary services while making higher returns on their down payments, making debt unions a recommended choice for those looking for helpful and affordable monetary remedies.

Neighborhood Participation and Assistance

Energetic area participation and assistance are indispensable facets of credit score unions' operations, showcasing their dedication to promoting neighborhood links and making a favorable influence beyond monetary solutions. Unlike typical financial institutions, lending institution focus on area interaction by actively getting involved in local events, supporting charitable reasons, and providing monetary education and learning programs. By being deeply embedded in the communities they offer, lending institution demonstrate an authentic dedication to enhancing the health of their participants and the neighborhoods in which they run.

With efforts such as offering, funding area events, and providing scholarships, debt unions establish themselves published here as columns of support for neighborhood homeowners. Credit rating unions commonly collaborate with various other regional businesses and organizations to deal with community needs see this website efficiently.

Personalized Financial Providers

With a concentrate on fulfilling the one-of-a-kind financial needs of their members, credit unions supply personalized economic solutions tailored to private conditions and goals. Unlike conventional financial institutions, lending institution focus on constructing connections with their members to understand their details financial circumstances. This personalized approach enables cooperative credit union to offer tailored remedies that line up with members' long-lasting objectives.

Cooperative credit union give a series of personalized financial services, consisting of customized economic examinations, customized financing products, and personalized investment guidance. By making the effort to understand each member's financial goals, credit rating unions can use appropriate and targeted assistance to aid them accomplish economic success.

Additionally, cooperative credit union typically provide personalized budgeting help and economic planning devices to aid participants handle their cash successfully. These resources empower participants to make enlightened financial decisions and work in the direction of their wanted monetary results.

Improved Customer Care

In the realm of monetary institutions, the stipulation of exceptional client service sets lending institution in addition to various other entities in the sector. Credit history unions are recognized for their commitment to placing participants initially, supplying a more tailored approach to customer service compared to traditional financial institutions. Among the essential advantages of credit history unions is the enhanced degree of customer support they provide. Participants frequently have direct accessibility to decision-makers, allowing for quicker responses to inquiries and a more tailored experience.

In addition, credit score unions typically have a strong concentrate on building partnerships with their participants, aiming to recognize their distinct financial demands and objectives. This personalized attention can cause far better economic recommendations and better item suggestions. Additionally, credit score union staff are commonly applauded for their friendliness, determination to assist, and overall commitment to participant complete satisfaction.

Final Thought

In final thought, credit rating unions use a series of advantages including individualized client service, reduced charges, far better rates, and area participation. By focusing on participant contentment and financial health, debt unions focus on offering their participants' benefits and helping them accomplish their economic objectives efficiently. With a Visit Your URL commitment to providing competitive prices and customized economic solutions, lending institution proceed to be a trustworthy and customer-focused option for people seeking financial help.

By discovering the advantages of credit unions additionally, one can uncover a financial institution that prioritizes its members' financial health and intends to build enduring partnerships based on count on and support.

Credit unions frequently use a selection of economic items and solutions, such as credit cards, home loans, and retired life accounts, all created to meet the diverse demands of their members. - Wyoming Credit

With a focus on satisfying the special monetary requirements of their participants, credit scores unions supply individualized financial solutions tailored to specific circumstances and goals. By focusing on participant complete satisfaction and economic health, credit report unions concentrate on offering their participants' best rate of interests and assisting them achieve their financial objectives successfully.